Will wrote:You state that we should have 'gold plated' social services until we can afford them. The problem is, what services would you cut at the moment? Furthermore, I can't see the other states being happy if we cut our social spending and expected the feds to foot the bill. They would expect the same.

Furthermore, whilst I agree that turning us into a tax haven would be good for business and improve our economic-related statistics, would this improved economic growth actually equate to improved hospitals, schools or infraestructure upgrades, considering these businesses would pay little or no tax? Would the avergae person actually notice any improvements to their life?

..

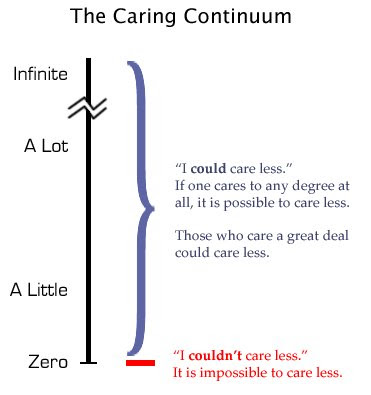

For starters, I know the RAH is a shoddy complex, but does spending over 1 billion in a new building really improve healthcare statewide? I would have thought new machinery, staff and research might have been money better spent.,Im sure the people of Mt Gambier or Bordertown or even Noarlunga could care less about the RAH, but do notice the llack of doctors in the outer areas. but that arguement has been done to death.

There are also the state beurocracies that do ....well very little really.

As for what the other states think of us cutting services to get a larger federal funding share....well NSW Vic and QLD have been at it for years. Remember our state got less in additional water funding because we had invested in water saving infastructure. Now the feds are paying NSW and VIC to achieve water savings in the MDB.

NSW QLD and VIC got the lions share of Gonski funding because they have under funded per capita in education. Once again we get a lower share of Federal funding.

Qld had no insurance plan in place for infastructure in case of natual disaster....guess what, a flood or two saw us paying through the nose in tax levies and lost infstrucutre projects to fund the repairs of one of our wealthiest states.

Finally, more business activity, results in more employment , higher wages (more disposable income) which attracts more population, building houses, roads employing even more people and federal infastructure as our economy becomes more important nationally and eventually more federal funding via GST.