Squadron of suitors prepare for the Virgin dogfight

By Glenda Korporaal

Associate Editor (Business)

and Damon Kitney

Victorian Business Editor

12:00AM May 16, 2020

Virgin Australia administrator, Deloitte’s Vaughan Strawbridge, jokes that his current role is akin to being a “marriage counsellor”.

His skills will be tested even more over the next month as he moves into phase two of the bidding process to keep the nation’s second-largest airline alive.

He needs to find the combination that will provide both the best financial deal for Virgin’s creditors — owed $7n — while setting Virgin up to survive and then thrive long-term.

The simple task of taking the highest financial offer on the table from the major bidding groups, which may be the case in any other ordinary administration, is complicated by the range of players with an interest in the future of Virgin, including employees, unions and governments.

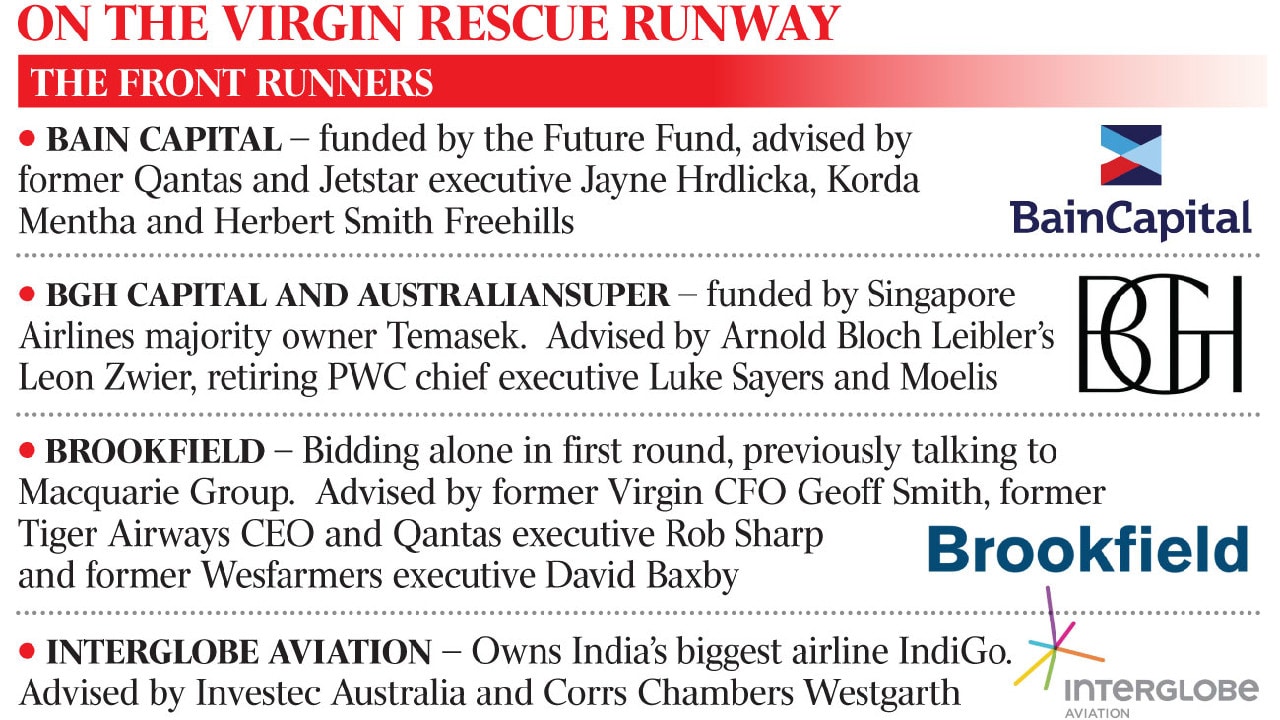

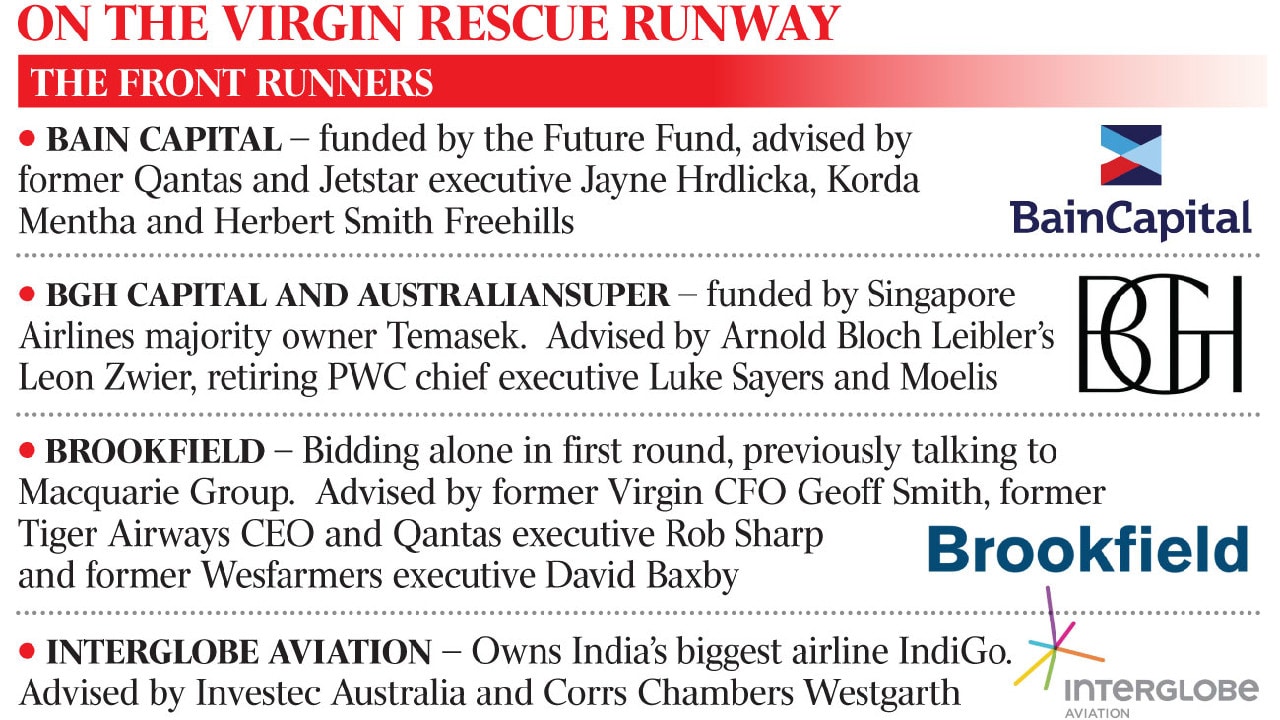

On the runway are four major players — a “Team Australia” bid from the $170bn AustralianSuper and Ben Gray’s BGH Capital (which have already been involved in several deals together), Bain Capital, Canadian infrastructure group Brookfield and Indian investor InterGlobe Enterprises, which is led by billionaire Rahul Bhatia, who co-founded budget carrier IndiGo.

Circling around, higher in the sky, are Richard Branson’s Virgin Group, Wesfarmers (which is said to be interested in Virgin’s loyalty arm Velocity), the Queensland government, the NSW government (which would like to see Virgin move its headquarters to the aerotropolis being built in western Sydney, around the city’s second international airport) and interests associated with Perth billionaire Andrew Forrest.

Any of these could find themselves linking up with the front runner.

The Queensland government has already openly signalled its interest in the process, offering a $200m sweetener to anyone who can guarantee the airline keeps its headquarters in Brisbane, where more than 8000 of Virgin’s staff are based.

Its investment arm, the Queensland Investment Corporation, led by chief executive Damien Frawley, plans to engage with bidders in the next stage of the sales process on how it can structure its involvement.

The Victorian government for the moment is keeping its powder dry.

Prior to Virgin going into administration it looked closely at a $500m package to save the airline, taking extensive advice from PwC and its retiring boss Luke Sayers.

However, The Australian understands while Premier Daniel Andrews was keen to pursue the plan, his Treasurer Tim Pallas was lukewarm and Pallas won the day. “So perhaps their appetite won’t be as big going forward, but given the Premier was keen, it will certainly be there,’’ said one observer.

In the background of any Victorian move lurks trucking billionaire Lindsay Fox, the owner of Avalon Airport, who is very close to Daniel Andrews and Luke Sayers, who is now advising the BGH consortium.

With foreign interests involved in three of the four main groups (four if one counts the fact that Singapore’s Temasek is a major funder of the BGH consortium), the final decision could come down to one man — federal Treasurer Josh Frydenberg, who makes the final call on major foreign investment deals.

While Virgin’s level of foreign ownership before it went into administration was around 96 per cent, the federal government is likely to prefer a deal with an Australian flag flying on it somewhere.

Some sources have suggested that Andrew Forrest’s private financial arm, now called Tattarang, could play a role with one of the predominantly foreign bidders, possibly InterGlobe, although no talks have been held between those two parties.

Strawbridge’s tightly scripted sales process with its strict deadlines has ruffled feathers already, with some critics complaining about a lack of information.

“It is difficult to see how any party to the process could venture an even half-way credible valuation based upon the extremely limited time and information made available to date,” one source said on Friday.

“Requests for information from the sell side have gone completely unanswered.”

Others have been unnerved by Stawbridge’s perceived close ties to the current Virgin management.

As one bidder put it on Friday: “It is a very weird process. The management are really trying to do a management buyout and looking for equity to support them.”

Strawbridge has been unashamedly clear he is a supporter of existing Virgin CEO Paul Scurrah and his team.

“What is encouraging for us is that the management team has gone through a transformation program and identified what is needed to do to take the business from what it was, which was a great airline, to being a good (financial) business as well,’’ he says.

“There were a host of initiatives which they had already started and are going through. Some of the things they have already done was restructuring Tiger and its action in reducing staff.”

This included closing Virgin’s New Zealand crew base, a move that involved cutting about 600 jobs, and laying off another 750 staff in Virgin’s head office.

“They have already taken those steps,” Strawbridge says.

“What we are able to do in the administration process is accelerating their transformation.

“There are a lot of things we can do which can reduce the cost base, including getting out of loss-making contracts and uncommercial contracts relating to aircraft.

“We have a unique opportunity through the administration process to reset the cost base.”

One specific issue that has perturbed some bidders has been the existing Virgin management’s determination to maintain its loss-making international operation.

Strawbridge has proposed the airline buy a fleet of long-range Boeing Dreamliner 787 aircraft to replace its current Boeing 777 and A330 fleet, but the time frame is not clear.

CAPA — Centre for Aviation executive chairman Peter Harbison says he was surprised to see the international business being retained in the so-called “Virgin 2.0” business plan.

“That is much higher risk than domestic.

“If you are talking about having those planes delivered in three years time, perhaps,’’ he said.

“2025 is likely, when you are going to see demand return for international. Demand is going to be very difficult for some years because of the economic situation. After the initial burst of cheap fares, the airlines are going to have to start charging real prices.”

Another bidder said the business post-administration needed to be set up in a way that it could survive.

“This should be the goal. It shouldn’t be about trying to accelerate an existing plan but to find the best plan for the future,’’ they said.

“It creates quite a lot of risk for creditors if you don’t have objectivity in evaluating what is the best approach here. It may not be what the current management’s plan is.”

“The COVID crisis is the one time in the perfect storm of aviation that you can reset an airline. You only have one shot in getting this done correctly.”

Maintaining Scurrah in his role seems to have the support of at least the Brookfield and BGH consortia.

Relations with the latter haven’t always been rosy — at least between its principal Ben Gray and the Virgin board.

Only days before Virgin collapsed under the weight of its $6.8bn in debt there were intense negotiations with BGH as Scurrah tried to secure enough funds to keep the airline alive.

But BGH declined to provide any financial support, which is said to have angered Virgin chairman Elizabeth Bryan and her directors.

However, they have now stepped out of the process and relations between Gray and Scurrah are said to be good.

The negotiations with the administrator for the BGH consortium are not being led by Gray but by his partner, respected former Macquarie banker Robin Bishop.

Scurrah insists that his major focus at the moment is working with Strawbridge and his team to deliver a successful sales process.

The latter acknowledges that each bidder will have their own view of how to best run Virgin going forward and admits it will be “up to who the buyer is as to who they want to hire in the management team”.

While Strawbridge has said he wants to sell Virgin as one package given the end-of-June deadline on the process, his marriage counselling role could bring together parties with different interests as he puts together the bid which best suits all the stakeholders.

The process could see parties with different interests in the Virgin group coming together over the next few weeks.

One observer suggested to the Australian on Friday that this could see, for example, InterGlobe, which runs a low-cost airline business in India, end up more focused on Virgin’s low-cost carrier Tiger Air.

Strawbridge has already made it clear that the shareholders in Virgin before it went into administration — Singapore Airlines, Etihad, China’s beleaguered HNA and Nanshan, Richard Branson’s Virgin Group and a small number of Australian shareholders — will not be getting anything financially out of the process.

The real question will be how much the group’s creditors, owed $7bn, get out of the deal.

The short answer may be not as much as they would like.

By all accounts they will have to take a serious haircut, particularly the unsecured creditors who are owed $2bn. Strawbridge’s main role is to report directly to Virgin’s myriad of creditors, which range from bank lenders to unsecured creditors, aircraft lenders, airports and the airline’s almost 10,000 employees.

While some see the frequent flyer loyalty program Velocity as something that could be spun off or sold down, Strawbridge argues that the best outcome for both is that they are sold together.

Virgin currently has 90 per cent of its fleet grounded and 80 per cent of its staff stood down.

Strawbridge says some existing shareholders are keeping a close eye on the process and want to continue their links with Virgin in some form.

“There are some existing shareholders who are incredibly supportive of this process,” he said.

“They believe the alliance relationship should continue and is very powerful and very important around the go forward of the Virgin business.

“There is a strong commitment from some of them to make sure that the alliance does stay alive.

“But whether or not they end up being part of any consortium, we don’t know.”

Next week will see a series of briefings and meetings between the short-listed bidders and parties such as Virgin’s management team.

“It is narrowing down to a really focused group of serious contenders who have done a huge amount of work and are incredibly engaged in the process,’’ Strawbridge says.

Interested parties not involved in Friday’s short-list of bidders could still end up being part of a final consortium.

Strawbridge says there are “different levels of interest in the business which might have a role later on in the process”.

He confirmed that there have already been changes in players in the potential bidding teams in the three weeks since he was appointed voluntary administrator on April 20.

His strict sale timetable has meant limiting his team’s time with would-be tyre kickers and giving more time and detail to serious players.

The serious contenders will start to get a lot more access to information from next week as the next round of the process continues.

“It is really setting up for the next phase, which is a highly engaged process with the short-listed parties we choose,’’ Strawbridge says.

“It’s a really intense process which will involve giving into the details of their offer, running management presentations and workshops and working with other stakeholders.

“We have a huge amount of work to do with the short-listed parties.

“The more information we have now, the better informed we can be and we can work with interest parties directly to help fill in gaps in their thinking or their plans.”

The Australian